Buying Property in Poland:

A Guide for Foreign Investors

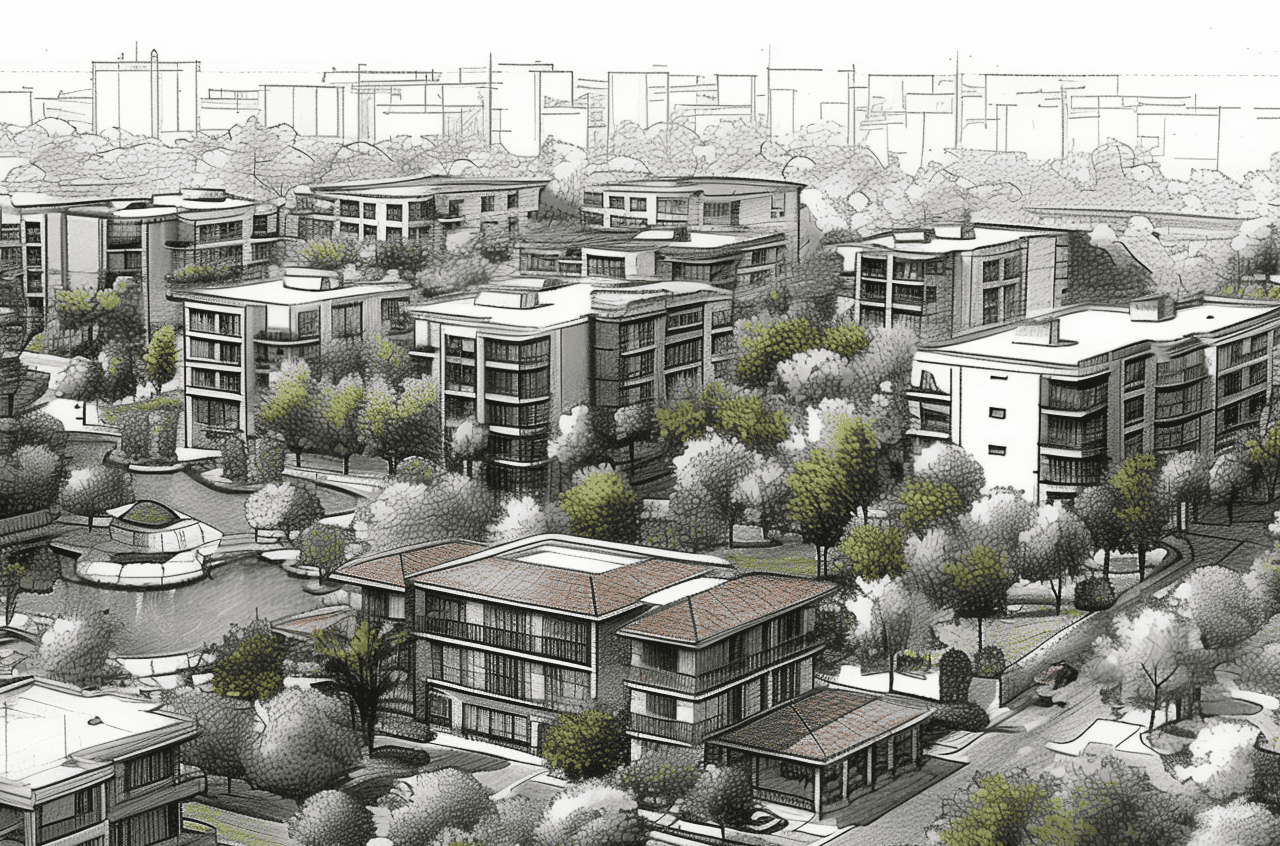

Does Poland’s burgeoning real estate market attract you? It’s no wonder that Poland’s dynamic economy and strategic location entice investors worldwide. This vibrant EU nation offers a variety of property opportunities, but understanding its market dynamics and legal intricacies is essential.

For foreign investors, Poland presents a blend of opportunities and challenges. Familiarise yourself with the legal framework, including tenant protection and property purchase laws. Investors must navigate permits, tax implications, and potential risks from residential to commercial properties.

In this guide, we break down every aspect of buying property in Poland. From regional market trends to negotiating tips, this article equips investors with the knowledge to make confident, legally sound investment decisions in Poland’s promising real estate landscape.

The Polish Real Estate Market for foreign investors

Poland’s real estate market is booming, fueled by robust economic growth, low interest rates, and favourable government policies. This environment attracts foreign investors, especially Europeans, who purchase without special permits. The country’s allure lies in its relatively affordable property prices compared to Western Europe, although these have risen recently.

Investors are drawn to Poland’s rental properties due to attractive yields, ranging from 2.4% to 5.1%. Major cities like Warsaw and Kraków are hotspots, offering ample business opportunities and rich cultural experiences. Understanding the types of property available – residential, commercial, or agricultural -is crucial for investing.

Here’s a quick overview of factors to consider:

Factor | Details |

|---|---|

Popular Cities | Warsaw, Kraków, Gdansk, Wroclaw, |

Yield Range | 2.4% – 5.1% |

Investment Types | Residential, Commercial, Agricultural |

In conclusion, Poland presents a compelling opportunity for real estate investments. Whether you’re interested in residential or commercial properties, working with experienced real estate agents can streamline the process. To operate the market smoothly, purchase prices and legal requirements must constantly be monitored.

Legal Framework for Property Purchase as a Foreign Investor

Before you buy a property in Poland as a foreigner, you need to understand a few key legal rules: who needs a permit, how the notarial deed works, and what protections you and your tenants have. For Europeans, particularly those from the European Economic Area, Switzerland, Norway, Iceland, and Liechtenstein, no special permit is needed to buy real estate for personal use. However, purchasing agricultural or forest land often demands a permit from the Ministry of Interior. These regulations ensure that real estate transactions align with national interests and are dictated by the Act on the Acquisition of Real Estate by Foreigners. The Polish Constitution guarantees the protection of private property while imposing specific ownership restrictions on foreigners to balance economic interests with national security.

Step-by-step: How to Buy Property in Poland as a Foreigner

Buying property in Poland as a foreigner becomes much less stressful when you follow a clear, structured process. Below is a practical step‑by‑step roadmap you can use as a checklist.

1. Define your investment goal and budget

Before looking at specific flats or houses, be clear about:

- Why are you buying: long‑term rental, holiday home, capital growth, mixed strategy?

- Your total budget in PLN/EUR/GBP, including:

- purchase price,

- notary and legal fees,

- property transfer tax or VAT,

- renovation and furnishing,

- contingency reserve (typically 5–10%).

Your strategy and budget will determine which cities and districts make sense.

2. Choose the right city and property type

Poland is not one uniform market. Warsaw, Kraków, Gdańsk/Tricity, Wrocław or Poznań offer different:

- tenant profiles (students, corporate tenants, tourists, local families),

- purchase prices per m²,

- achievable rental yields.

Decide whether you are targeting:

- a city‑centre flat for long‑term rental,

- a smaller studio near universities,

- a property in a tourist area,

- or a more niche asset (commercial, small multi‑let, etc.).

3. Arrange your legal and tax foundations

Before you sign anything:

- Obtain a Polish Tax Identification Number (NIP) if required for your structure.

- Decide if you buy:

- as a private individual,

- via a local company,

- or via an existing foreign structure (and how it will be taxed in Poland and in your home country).

- Consult a lawyer or tax advisor about:

- expected taxes on rental income,

- capital gains tax on exit,

- double‑taxation issues.

This step prevents expensive surprises years later.

4. Check whether you need a permit

Most foreigners buying standard apartments do not need a special permit, but:

- non‑EU/EEA buyers,

- purchases of agricultural or forest land,

- or land close to borders

may require permission from the Minister of the Interior and Administration (MSWiA).

Before you fall in love with a specific plot or house with land, confirm whether a permit is needed and how long it will take.

5. Secure financing (if you use a mortgage)

If you plan to finance the purchase with a Polish mortgage:

- Speak with 1–2 banks or a broker early in the process.

- Clarify:

- minimum down payment (often around 30% for non‑residents),

- documentation required (income proof, tax returns, bank statements),

- whether your foreign income is acceptable.

Get a realistic indication of borrowing capacity before you make any binding commitments.

6. Select the property and negotiate the price

Once you have your target city and budget:

- Shortlist properties that match your strategy (yield, location, condition).

- Check:

- building standard and year,

- service charges (czynsz do wspólnoty / spółdzielni),

- realistic rental level for that location.

Negotiate the price based on:

- recent comparable sales,

- property condition,

- any upcoming building works.

7. Conduct legal and technical due diligence

Before you sign or pay a significant deposit, arrange:

- Independent technical survey – to identify hidden defects, moisture issues, structural problems, etc.

- Legal due diligence, including:

- checking the Land and Mortgage Register (Księgi Wieczyste),

- confirming the seller’s rights to sell,

- identifying any mortgages or encumbrances,

- verifying planning and zoning status.

This is where a local expert adds the most value and reduces your risk.

8. Sign the preliminary purchase agreement („umowa przedwstępna”)

In most transactions, you will first sign a preliminary agreement that sets out:

- purchase price and payment schedule,

- deadlines for signing the final notarial deed, What happens if one party withdraw?,

- Who pays which taxes and fees?

At this stage, you usually pay a deposit (zadatek / zaliczka) of around 10–20% of the purchase price. Make sure the contract clearly defines when and how you can recover it if the transaction fails for reasons beyond your control.

9. Sign the final notarial deed and pay the remaining amount

The final purchase agreement is signed in the presence of a notary public. At this point, the remaining purchase price is paid.

- All conditions from the preliminary agreement should be fulfilled,

- The notary applies to update the Land and Mortgage Register with your ownership.

If you are abroad, this step can often be completed via a power of attorney granted to a trusted representative.

10. Register ownership, handle taxes and set up rental

After completion:

- Confirm that you are correctly entered as the owner in the Land and Mortgage Register.

- Pay:

- property transfer tax (if applicable),

- notarial and court fees,

- any VAT due for certain types of properties.

- If you plan to rent the property:

- decide on the rental model (long‑term, mid‑term, short‑term – where permitted),

- prepare a compliant rental agreement,

- register for the appropriate tax regime on rental income.

Following these steps helps you turn what can feel like a complex cross‑border transaction into a structured, manageable process.

Overview of the Civil Code

Poland’s Civil Code (Kodeks Cywilny) is the backbone of real estate transactions within the country. It demarcates the roles and responsibilities of buyers, sellers, and landlords, ensuring a transparent and fair process. Key provisions cover contracts of sale, leases, and property rights, offering a structured process for engaging in real estate dealings. This comprehensive legal framework safeguards property owners under Polish law, providing robust legal protections. For foreign investors, grasping the Civil Code is indispensable, as it sets forth the fundamental legal requirements for handling property transactions in Poland. It works in synergy with other legal acts, including the Act on the Protection of Tenants’ Rights, to provide a multifaceted legal structure for property matters in the country.

Act on the Protection of Tenants’ Rights

The Act on the Protection of Tenants’ Rights ensures tenant welfare in Poland. This legislation safeguards tenants by granting them the right to enjoy rented properties peacefully, free from landlord interference. It includes strong protections against unjust evictions, mandating landlords to adhere to due legal process. Tenants can expect landlords to undertake necessary repairs, ensuring the property remains habitable. Polish law enforces that rental agreements clearly detail tenants’ rights and obligations, including termination protocols. Furthermore, landlords must ensure that essential utilities such as heating, plumbing, and electrical systems remain functional, upholding tenant living standards per the legislation.

Types of Properties Available for Purchase

Poland offers a variety of property options suited to different investment strategies. Each property type presents unique opportunities and legal requirements, from bustling urban apartments to expansive agricultural land. Foreign investors must consider zoning regulations, usage permits, and legal documentation when purchasing different kinds of property in Poland. Understanding these elements ensures a smooth real estate transaction that aligns with investment goals and Polish law compliance.

Residential Properties

Residential properties in Poland are rapidly appreciating and are driven by urbanisation and economic growth. Foreign investors can buy, sell, and lease these properties without restrictions, making them an attractive asset. The current average price for residential properties is approximately €2,697 per square meter, steadily increasing. Five years ago, a 100 m² apartment was priced around €189,000, whereas today, it’s about €270,000. Investments in these properties are considered liquid, offering both stability and potential profit from price appreciation.

Commercial Properties

Commercial properties in Poland present a lucrative opportunity due to the country’s thriving economy and growing real estate market. EU and EEA nationals will find the purchase process straightforward, similar to residential properties. However, non-EU investors may encounter more stringent regulations, particularly for properties near sensitive or border areas. It is crucial to engage legal advisors who can navigate Polish law, ensuring compliance with zoning regulations and ownership verification. Opportunities range from office buildings to industrial spaces, offering distinct advantages depending on investment goals.

Entitlements and Restrictions for Foreign Investors

Poland’s real estate market offers promising opportunities for foreign investors, safeguarded by an EU-aligned legal framework. This ensures foreign investors enjoy the same property rights as Polish citizens and benefit from robust protections against unlawful expropriation. However, non-European Union investors might encounter specific restrictions. These often involve needing a permanent residence permit or other permissions from the Ministry of Internal Affairs to proceed with real estate transactions.

Understanding the Act of March 24, 1920, is crucial for foreign investors. This law details who qualifies as a foreign investor and the necessary permits for purchasing specific properties in Poland. Engaging a notary public and a sworn translator is advisable to navigate the legalities successfully. This partnership ensures that all agreements and permits are meticulously managed. Despite these regulations, foreign investors do not need to reside in Poland during transactions. Granting power of attorney is a feasible option for handling property dealings remotely.

Need an Independent Legal & Technical Check Before You Buy?

Buying in another country without local support can be risky.

Varso Invest coordinates independent legal and technical surveys for foreign investors in Poland – so you know exactly what you are buying before you transfer any serious money.

Book a free 20‑minute consultation →

Permits Required for Property Purchase

Foreign investors who purchase property in Poland should know several permit requirements. Real estate acquisitions typically proceed without a permit from the European Economic Area (EEA) or the Swiss Confederation. However, non-EU/EEA individuals and legal entities may encounter different regulations. They often need permits, particularly when acquiring larger land parcels like agricultural or forest land, though apartment purchases generally do not require permits.

For these investors, navigating the permit process involves understanding specific requirements outlined by the Ministry of Internal Affairs. Conducting a comprehensive analysis to determine if a permit is required, particularly for land acquisitions, is crucial. Awareness of these requirements helps streamline property transactions and ensures compliance with Polish law.

Understanding the permit landscape is essential for foreign buyers in Poland. With the proper guidance and preparation, investors can smoothly navigate the process and capitalise on Poland’s booming real estate market.

Tax Implications and Financial Considerations

When buying property in Poland as a foreign investor, it’s crucial to consider various taxes and fees associated with the transaction. These costs can impact your real estate investment’s budget and long-term financial planning. Understanding these monetary obligations ensures a seamless purchase process, minimising unwelcome financial surprises.

Overview of Property Taxes

Property taxes in Poland are an annual obligation and vary based on a property’s location and size. Typically, these taxes range from 0.5% to 2% of the property’s value. Additionally, foreign investors should be aware of the capital gains tax, which is 19% on net gains from selling a property held for less than five years, impacting the seller.

Rental income from Polish properties is taxed progressively, ranging from 18% to 32% after allowable deductions. Furthermore, a property transfer tax of 2% on the market value is charged for pre-owned property rights transfers, usually settled by the buyer. Legal documentation steps are essential for

Financing Options for Foreign Investors

Foreign investors looking to finance their property purchase in Poland have several options, although terms are influenced by nationality and bank policies. Polish banks often demand a higher down payment from non-residents, generally around 30% of the property’s value. This ensures the buyer has significant equity in the property investment.

Interest rates and terms offered by Polish mortgage lenders are crucial factors to consider when assessing financing options. An investor’s financial standing will significantly influence approval chances and the attractiveness of the terms. Therefore, comprehending and navigating Poland’s financing landscape is essential for efficiently funding property acquisitions.

Legal Documentation for Property Transactions

Purchasing property in Poland involves legal documentation steps essential for foreign investors and Polish citizens. A key requirement is the presentation of valid identification, such as a passport. Acquiring a Tax Identification Number (NIP) or an EU VAT number is crucial for any property transaction. Buyers must verify the legal status of the property, including ownership and any encumbrances, to ensure that their investment is secure. Notarising all property sales agreement documents the official change of ownership so that the transaction is legally binding. Finally, registering the property in the Land and Mortgage Register is vital to officially changing ownership.

Preliminary Purchase Agreements

Preliminary Purchase Agreements, known as “umowa przedwstępna,” are fundamental for outlining the initial terms of a property deal in Poland. This includes the agreed purchase price, payment schedule, and specific conditions. Upon signing, a deposit ranging from 10% to 20% of the property price is typically required to demonstrate the buyer’s commitment. This agreement protects buyers by recording their interest legally, guarding against the sale of the property to another party. Transitioning from a Preliminary Agreement to a final contract is essential to complete the purchase and officially record ownership.

Final Purchase Agreements

Final Purchase Agreements are the culmination of the property buying process, and for foreign investors, this requires careful attention to legal details. Foreign buyers must often provide an earnest money deposit to secure the transaction. Operating in the Polish language and legal requirements demands precise communication to ensure the final contract meets all expectations. In major Polish cities, the high demand for properties influences the urgency and complexity of finalising these agreements. The final purchase agreement includes fulfilling all stated conditions within a specified timeframe to complete the transaction and achieve a smooth ownership transfer.

Property Registration Process

When buying property in Poland, it is essential to register it in the Land and Mortgage Register (Księgi Wieczyste). This registry confirms new ownership and ensures transparency in property transactions. To register, you must submit the signed sales agreement, proof of payment, and other required documents to the local court.

Here’s a quick checklist for the registration process:

- Signed sales agreement

- Proof of payment

- Additional necessary documents

- Flat registration fee of PLN 200

The Land and Mortgage Register is accessible to the public and provides records of ownership, mortgages, and encumbrances. This transparency is vital for securing financing or future property sales. The registration formally transfers ownership and establishes your legal rights for any real estate dealings.

In summary, ensure all documents are in order and pay the registration fee to complete the process.

Regional Differences in the Polish Market

The Polish property market varies significantly across major cities and regions, offering diverse opportunities for foreign investors. Major Polish cities like Warsaw, Kraków, and Gdańsk have notably higher property prices, driven by robust rental demand and economic opportunities. Central locations in these cities demand premium prices, whereas suburban and regional areas present more affordable options. Despite these price variations, Poland remains more accessible than many Western European countries, although there is a general trend of rising property values across the nation. The market’s popularity with international investors is growing, particularly in cities like Warsaw, Kraków, and Wrocław, underscoring the strong market growth these regions have experienced.

Popular Investment Locations

Poland boasts several cities and regions that have become popular with foreign buyers. The Tricity area, comprising Gdynia, Sopot, and Gdańsk, is highly sought after due to its seaside allure, cultural attractions, and promising economic climate. Warsaw, Kraków, and Gdańsk are top choices for international property buyers attracted by financial strength, cultural diversity, and various real estate types. The Baltic Sea coast and the Tatra Mountains attract those seeking vacation homes or quiet retreats. Poland‘s low cost of living, vibrant culture, and efficient public transit make it an inviting environment for expatriates.

Emerging Markets and Opportunities

Thanks to its resilient economy and strategic location, Poland has emerged as one of the most appealing real estate markets in Central and Eastern Europe. Strong economic growth, favourable interest rates, and government support have propelled the market forward. Over the past five years, Poland’s GDP per capita has grown by 15.9%, increasing national wealth and demand for real estate investments. Rental properties, mainly, are attractive for investors, offering moderate yields between 2.4% and 5.1%. Major cities like Warsaw, Kraków, and Gdańsk have seen a swell in demand from local and foreign investors, highlighting the ongoing opportunities in these burgeoning markets.

Risks and Legal Protections

Foreign investors must be aware of potential risks and the legal protections when buying property in Poland. The country’s property market can be lucrative but requires careful consideration of legal aspects to avoid pitfalls. Understanding these factors helps ensure a smooth investment process, safeguarding foreign buyers’ interests and investments.

Common Risks in Property Investment

Foreign investors face several risks when purchasing property in Poland. One common issue is buying property in a land registry dispute, which can lead to protracted legal battles as multiple parties claim ownership. Additionally, properties built illegally or not adhering to local building regulations pose significant challenges, potentially resulting in fines or demolition.

Acquiring real estate that carries an existing mortgage also presents risks. If the investor cannot meet the mortgage obligations, foreclosure is possible. Furthermore, undisclosed legal persons or entities involved in the transaction can complicate due diligence efforts. Proper checks and compliance with permits and agreements mitigate these risks, ensuring a secure property investment.

Legal Protections for Buyers

Buyers investing in Polish real estate benefit from a robust legal framework. A critical part is the notarial deed for property purchases, which formalises agreements and protects both parties. Notaries verify sale agreements, ensuring compliance with Poland’s legal requirements and mitigating potential disputes.

Foreign investors from the European Economic Area, the Swiss Confederation, and other specified regions do not need special permits to buy property in Poland. However, the Act on Land Acquisition by Foreigners outlines specific regulations for certain properties, providing legal protection throughout the process. Engaging a skilled lawyer is crucial for navigating legal complexities, reviewing contracts, and securing buyer interests in Polish real estate transactions.

Negotiation Tips for Investors

Building personal relationships with local stakeholders, including real estate agents and legal advisors, is crucial for a smooth negotiation process in Poland. Respect for authority and hierarchy is essential, so use proper titles when addressing individuals. Polish culture also values punctuality and professionalism, and can positively influence negotiation outcomes.

Negotiations in Poland often start informally, but must be formalised as a notarial deed to be valid. Understanding cultural nuances, such as engaging in friendly conversations and showing respect, can significantly enhance the success of property negotiations.

Here are key negotiation tips for foreign investors in Poland:

- Form Personal Connections: Establish trust with local real estate agents and legal experts.

- Observe Cultural Etiquette: Use proper titles and respect authority.

- Be Professional: Maintain punctuality and professionalism.

- Focus on Formalisation: Ensure the final agreement is a notarial deed.

These strategies can help improve your experience and success in Polish property investments.

Conclusion: Making Informed Investment Decisions

Investing in Poland’s real estate requires comprehensive research and expert legal guidance. Foreign investors must understand the legal frameworks to navigate residential and commercial properties effectively. They should always seek specialist advice to ensure compliance with Poland’s legal requirements and obtain any necessary special permits.

Financial planning is crucial. To prevent unexpected expenses, account for transaction taxes and potential VAT for commercial properties. With Poland’s economic growth and high property demand, well-planned investments can yield lucrative returns.

Understanding market dynamics, including urbanisation trends and rental demand, can enhance investment success. A knowledgeable approach, supported by real estate agents or agencies, will significantly minimise risks.

Key Considerations:

- Seek legal and financial counsel.

- Plan for taxes and VAT.

- Research market trends.

- Utilise professional real estate services.

With the right strategies, investing in Poland’s vibrant real estate market can be rewarding. Investors can actively participate in the growth of major cities and emerging areas, embracing opportunities in residential, commercial, and agricultural land sectors.

Understanding the Legal Framework

The cornerstone of purchasing property in Poland as a foreigner is understanding the legal requirements set forth by Polish law. The principle rule is that foreigners need special permission from the Minister of the Interior and Administration (MSWiA) to acquire real estate. This requirement stems from the Act on the Acquisition of Real Estate by Foreigners and is designed to regulate foreign ownership within the country.

Who is Considered a Foreigner?

In this context, the definition of a “foreigner” includes individuals without Polish citizenship, legal entities based abroad, partnerships without legal personality formed according to foreign law, and Polish-based entities or partnerships controlled by foreigners.

Exemptions and Special Conditions

There are several exemptions to the rule requiring ministerial permission:

- EU, EEA, and Swiss citizens enjoy more freedom and can purchase properties without special permission, thanks to agreements established when Poland joined the EU. However, restrictions remain on acquiring agricultural lands.

- Exceptional cases where PERMISSION IS NOT REQUIRED include purchasing standalone residential properties that meet adequate living conditions, garages, properties after residing in Poland for at least five years under permanent residence or long-term EU resident status, and properties as part of the marital community with a Polish citizen after residing in Poland for at least two years.

The Application Process

Foreigners who apply for permission must demonstrate their ties to Poland, which can be through Polish nationality or descent, having a Polish spouse, having various types of residence permits, controlling a company, or conducting business in Poland. The application involves a detailed submission of documents, including an extract from the business register (if applicable), land and mortgage registry statements, zoning plans, and proof of financial means to purchase the property.

What Properties Can Be Bought Without Permission?

Foreigners can buy residential properties, such as apartments or houses that provide suitable living conditions, without seeking special permission. Additionally, they can purchase garages or shares in a garage if it’s for personal use and they already own property in Poland. After living in Poland for at least five years and having permanent residency status, foreigners can buy property without permission. Similarly, properties can be acquired without the consent of family members if certain conditions are met, such as being entitled to inherit from the seller who has had ownership or perpetual usufruct for at least 5 years.

How Varso Invest Helps Foreign Investors in Poland

Buying property in a foreign country can feel overwhelming – different laws, language, market customs and risks. This is exactly where Varso Invest steps in.

We specialise in working with foreign investors who want to buy in Poland (and compare it with more mature markets like the UK). Our role is to make your purchase process safer, clearer and more efficient.

Here is how we typically help:

Independent property sourcing

We are not tied to any single developer or high‑street agency. We help you:- identify cities and districts that fit your strategy and budget,

- source properties that match your yield, risk and liquidity expectations,

- avoid over‑priced or problematic assets that are heavily pushed to foreigners.

Legal and technical due diligence coordination

Before you commit to a purchase, we coordinate:- independent technical inspections to uncover hidden defects,

- legal checks of the Land and Mortgage Register, ownership, encumbrances and permits.

Our goal is simple: you only proceed once the property is properly checked.

Support with structure, banks and taxes

We connect you with trusted local partners (lawyers, tax advisors, mortgage brokers) so you can:- choose a tax‑efficient purchase structure (private vs company),

- understand your tax obligations in Poland and in your home country,

- realistically assess financing options with Polish or foreign banks.

End‑to‑end guidance – even if you are abroad

Many of our clients complete most of the process remotely. With a proper power of attorney and clear communication, we help you:- navigate preliminary and final agreements,

- coordinate signatures with the notary,

- handle practical post‑completion steps so the property is ready for rental.

FAQ

How can foreign investors obtain financing in Poland?

Foreigners interested in purchasing property in Poland can access mortgage loans, although the criteria vary widely among lenders. A valid residence permit and proof of income are typically prerequisites. The specific terms and conditions are determined by individual financial institutions like PKO Bank Polski, Bank Pekao, and Santander Bank Polska, which are known to provide mortgages to non-residents. Mortgage rates for a 20-year term generally fall between 5% to 9%, aligning with Poland’s market averages. Foreign investors should be prepared to meet these requirements to secure financing successfully.

Are there any restrictions on purchasing agricultural land?

Purchasing agricultural land in Poland comes with more stringent regulations for foreigners. Non-EU citizens must obtain a special permit from the Ministry of Interior due to national security and public interest considerations. Even EU, EEA, and Swiss citizens face transitional restrictions, despite general permit exemptions. The Act on the Acquisition of Real Estate by Foreigners specifies these regulations. Furthermore, any land exceeding a specific area involves additional scrutiny. This process ensures that land acquisitions align with Polish laws and policies.

What are the ongoing costs of property ownership in Poland?

Owning property in Poland involves several recurring expenses. Real estate tax is calculated based on the property’s location and size. Additionally, owners must budget for housing cooperative rent if applicable. Maintenance costs for repairs and renovations are also necessary considerations. The property tax can range from 0.5% to 2% of the property’s market value annually. Administrative duties such as a registration fee, approximately 0.1% of the property’s value, should also be anticipated. These ongoing costs are essential for maintaining property in good condition and complying with Polish regulations.